- Home >

- Social Responsibility >

- Our Role as an Institutional Investor >

- Sustainable Investment

Sustainable Investment

Sustainable investment method

Components of the Company's sustainable investment method are defined as follows.

| Sustainable Investment Method | Definitions | |

|---|---|---|

| Integration | Systematically incorporate environmental, social, and governance factors into the process of investment decisions with the aim of reducing portfolio risk and enhancing returns | |

| Positive screening | Build a portfolio of companies with high ESG ratings | |

| Negative screening | Exclude certain industries, companies, etc. from the portfolio | |

| Sustainability thematic investment | Investments to assets with themes that lead to solutions to social issues, based on the premise of profitability (Environment & climate solution investment : of which investment that contribute to solving environmental and climate change issue) |

|

| SDGs bond | Investment to international organizations that promote projects that contribute to the achievement of the SDGs (Green Bonds, Social Bonds, Sustainability Bonds, etc.) | |

| SDGs project | Funding for projects that contribute to the achievement of the SDGs (social infrastructure development, environmental conservation, etc.) | |

| Impact Investment | Investment that aims to both generate investment income and social impact | |

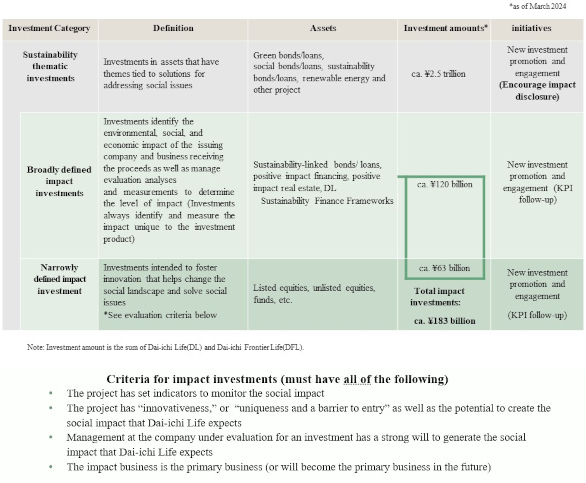

< Investments to Create a Positive Impact on Society (the Definition of Impact Investment) >

We began impact investments centered upon unlisted equities in FY2017 (listed equities added from FY2020). We select these according to the vision of solutions and innovations to overcome social issues and regularly monitor the social impact after investing.

In an effort to further expand the positive impact of the investment portfolio, from FY2022, investments that require the identification and measurement of impact due to the characteristics of the investment product will also be included in "impact investments" and impacts will be monitored.

We also will measure the social impact of sustainability thematic investments and encourage investees to disclose their impact through engagement with investee organizations.

Initiatives for Sustainability thematic investment

Achievements and Targets of Investments Addressing Social Issues

In order to contribute to the realization of a sustainable society, Dai-ichi Life and Dai-ichi Frontier Life aim to accumulate 5 trillion JPY for sustainability thematic investments by the end of March 2030 (DL and DFL combined), including 2.5 trillion JPY for investments that contribute to the solution of environmental and climate change issues. As of the end of FY2024, DL and DFL showed steady progress with 3.1 trillion JPY for sustainability thematic overall / 1.5 trillion JPY to the solution of thematic investments. We have set these targets based on the global funding gap for the realization of a sustainable society by 2030 and the AUM of DL and DFL.

To expand positive impacts, we have set their GHG reduction contribution target to 2.4 million tons of CO2e / year by 2026; however, the target (3 million tons of CO2e / year) has already been achieved in FY 2024. Therefore, we set a new target to achieve 4.5 million tons of CO2e / year by FY2029 to further expand positive impacts.

- *1 Include renewable energy power generation projects for which estimates can be made based on the amount of electricity generated (measured in accordance with PCAF standards), and green bonds that disclose their impact (including the data provided by ICE Date Services)

- *2 Consider the funding gap towards achieving the SDGs for sustainability thematic investments, and funding gap towards net zero by 2050 for environmental & climate solution investments

- *3 OECD (2022), Global Outlook on Financing for Sustainable Development 2023

- *4 NZAOA (2023), Unlocking Investment in Net Zero

- *5 (Expected funding by private financial institutions by 2030) × (AUM of DL and DFL) ÷ (total AUM of PRI - signatory financial institutions)

Promotion of Investments to Solve Environmental and Social Issues

With a view to realizing a sustainable society, Dai-ichi Life promotes sustainability thematic investments, that contribute to addressing environmental and social issues, and strives to create positive impacts.

Considering the connection with its Core Materiality, the company categorized major positive impacts created through investments into environmental impacts (climate change, natural capital) and social impacts (health & healthcare, financial inclusion, and diversity).

- Note 1: For investments by Dai-ichi Life and Dai-ichi Frontier Life that disclose impact, measurements are conducted taking into account the company's shareholding (with some of the measurement results including data provided by ICE Data Services).

- Note 2: The avoided GHG emission through the electricity generation business using renewable energy is calculated based on the concept provided by "PCAF."

PCAF is a global initiative to develop methodologies for measuring and disclosing GHG emissions of investment portfolios. - Note 3: Impact of safe water supply, malnutrition treatment for children in emerging countries, financial inclusion, and diversity promotion may include the impact before the investment by DL and DFL because cumulative values are partially included.

Examples of Main thematic investments

|

|

|

| In May 2020, Dai-ichi Life provided ¥2 billion to a microfinance loan scheme for developing countries in which Crédit Agricole Tokyo Branch acts as the borrower. The funds obtained through the loan scheme are provided to the Grameen Crédit Agricole Foundation so that they are lent to local microfinance institutions that aims to support the promotion of women's empowerment and economic development. | ||

|

|

|

| In March 2022, Dai-ichi Life invested ¥3 billion into repackaged products backed by financing for the African Export-Import Bank (Afreximbank). The funds the Company has invested in will be directed to medical and pharmaceutical projects in African countries, including much-needed support to procure and supply COVID-19 vaccines. Through this investment, the Company will provide financial support for Afreximbank's efforts to help African countries affected by the COVID-19 pandemic. |

||

|

|

Source: ADB |

| Dai-ichi Life invested approximately ¥6 billion in Education Bonds issued by the Asian Development Bank "ADB". The bond will strengthen its support for increasing opportunities for high-quality education following COVID-19 through efforts such as greater use of distance and online learning and use of digital technologies for scaling equitable learning, training and teaching with partnerships for expanding access to affordable and reliable internet connectivity. |

||

|

|

Source: ADB |

| In November 2017, Dai-ichi Life invested approx. ¥10 billion in the Gender Bond issued by the Asian Development Bank (ADB) .The proceeds raised through the Gender Bond will be used for projects to promote gender equality and women's empowerment in the Asia-Pacific region. | ||

|

|

|

| In December 2017, Dai-ichi Life invested approx. ¥4.4 billion in one of the world's largest desalination projects being undertaken in Australia to cope with water shortages associated with large-scale drought and future population growth. | ||

|

|

Source: Sharing Energy |

| In October 2024, Dai-ichi Life invested ¥1.3 billion in the project for roof-mounted low-voltage distributed solar power generation systems for over 2,000 individual residences distributed throughout Japan. | ||

|

|

Photo credit: MPower Partners GP, Limited |

| In May 2021, Dai-ichi Life invested in global venture capital fund "MPower Partners Fund L.P.". With the goal of empowering entrepreneurs providing tech-enabled solutions to societal challenges, the Fund has established healthcare / wellness, financial technology, next-generation work / education, next-generation consumer, and environment / sustainability as its key fields of investment, and invests in Japanese and overseas startups in these areas. | ||

|

|

Source: Japan Entertainment |

| in 2025 Dai-ichi life invested in a new theme park based on the natural environment of Yanbaru, which is scheduled to open in the northern part of Okinawa Prefecture (Nakijin Village and Nago City). | ||

|

|

|

| In October 2021, Dai-ichi Life invested in a social impact bond for a community development project in Maebashi, Gunma Prefecture. The project aims to increase pedestrian traffic on Babakawa Street and revitalize the surrounding area. | ||

|

|

Source: Aichi Prefecture |

| In February 2025, Dai-ichi Life fully purchased bonds issued by Aichi Prefecture with proceeds exclusively allocated to flood control (green bond) and earthquake countermeasures, totaling JPY 5.0 billion. The funds raised are allocated to river and coastal improvement projects as part of adaptation measures to rapidly progressing climate change. |

||

|

|

Photo credit: Anglian Water Services Financing PLC |

| In September 2021, Dai-ichi Life invested approx ¥3.9 billion in a green bond issued by Anglian Water Services Financing PLC ("Anglian Water"). The proceeds raised from this bond will be used toward natural water treatment facility maintenance projects which utilize wetlands, projects which promote the inhabitation of indigenous species by conducting maintenance on the flow of rivers and waterfronts to restore the characteristics of natural rivers, and the like. | ||

Impact Investment

Dai-ichi Life engages in impact investment, an investing method intended to both gain investment returns and create positive social impacts. We conduct ongoing monitoring of companies that have received impact investments with regard to the progress of their initiatives and social impacts. Some of our leading examples are as follows.

Integration Initiatives

Integration into Research

Dai-ichi Life integrates environmental, social, and governance factors into each asset according to asset characteristics to continually push forward action that increases the sophistication of integration.

Enhancing Sophistication of Integration

- *Includes listed equities, emerging markets listed equities, and private equities

Integration Methodology (Equities, Corporate Bonds, Loans)

Dai-ichi Life optimally integrates environmental, social, and governance factors into each asset according to liquidity and characteristics, and then appropriately reflects these in investment decisions.

Sustainability analysts select priority themes from various sustainability issues, and then conduct cross-sector research and analysis. A sustainability assessment is performed on a theme basis, and the results of the assessments are shared with equity / credit analysts. Each asset analyst references such results when considering the internal rank of each company.

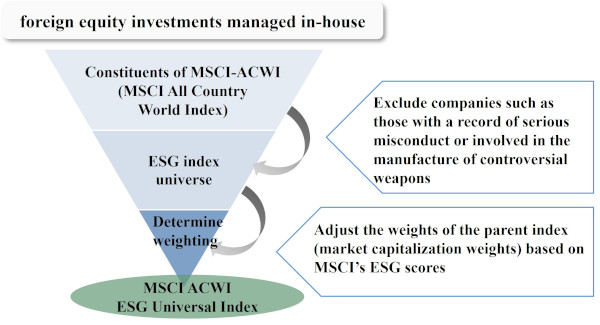

Positive Screening (Foreign Equities)

From September 2020, ESG index is adopted as investment targets (benchmarks) for foreign equity taking environmental, social and governance factors into account in overall foreign equity managed inhouse.

Negative Screening

Dai-ichi Life determines the scope of negative screening in consideration of the characteristics of the life insurance business and the sustainability of society.

Fossil fuel resource development projects, transportation and storage projects, and thermal power plant-related projects are the subject to the negative screening policy. As a responsible investor, it is important to support the transition of existing fossil fuel businesses. Therefore, we will make individual investment decisions on projects that contribute to transitions, based on internationally recognized Net Zero scenarios and the status of technological innovation.