Global Venture Partner

for the Future

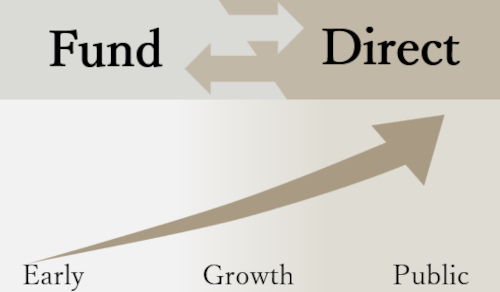

Investment Style

We invest in both VC funds and startups, covering a wide range of stages from seed to late-stage rounds.

For the Japanese venture ecosystem, we offer global insights gained through our overseas fund investments.

As an institutional investor, we provide long-term capital with a view toward the post-IPO phase.

Fund

We invest globally, focusing on seed to early -stage funds. We also invest in emerging managers to expand the venture ecosystem.

Direct

We primarily invest in domestic startups at mid to late stages, with no restrictions on our holding period.

Portfolio

Over the past 10 years, we have invested a cumulative total of more than $900 million across numerous funds and startups.

●Impact Investment

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Sustainability

We pursue an investment approach aimed at generating both financial returns and positive social impact.

Source:Gojo & Company(Impact Investment Case Studies)